The weekly budget planner is an excellent way to calculate liabilities and your home expenditure development costs your home. Budgeting is an important part of a sturdy financial base. Having a weekly budget planner helps you manage your money, control your expenses, save more money, repay your liability, or stay yourself out of debt.

Table of Contents

Without a precise weekly budget planner, you can’t easily count on your credit card and loan to eat and pay your bills. In case you already have one, then simply update it.

How To Make Weekly Budget Planner?

To create a weekly budget planner first, make a list of your income and add all the credible sources of your income as well as expenditure. Such as salary from a job, child support, etc. Your budget should be a document that you can depend on.

Calculate Your Net Income:

Calculate your net income. After your bill payment, your net income has been waived. You want it to be a positive number so that you can keep it towards your debt. Calculate your net income by deducting your expenses from your monthly income and write down the number, even if it’s negative.

If you occasionally get money from separate hobbies or jobs, but it is not on a regular basis, do not make it as income on your budget.

In case you have an unstable income or you are self-employed, then use the regular monthly income or an approximation of the income you would like to receive in that month.

| single mom budget tips | weekly budget planner |

|---|---|

| bi weekly budget template | cost of education |

| simple party food ideas on a budget |

Make A List Of Income And Expenditure:

Some of the monthly expenses are certainly such as a mortgage, property tax, rent, child support, and scope. Other expenses may be different such as the electricity bill, water bill, groceries bill, etc. are variable.

For the variable expenditures, write the extreme amount spent in that group or write the amount that you expect in your bill. For example, you plan to spend INR 2000/- on groceries and INR 750/- on gas, etc.

NOTE:

You can use your bank statement to understand how much you usually spend each month and to ensure that you are not spending any type of extra expenses.

Adjust Your Expenses:

If you are left with no savings, it means that you have planned to spend extra than your income. You have to fix it; otherwise, you will be in trouble during the month. Variable spending is usually the first place that you can adjust to the expense, e.g. Even groceries, food, hobbies, gas, etc.

You can also adjust for certain expenses, for example, reduces your cable or phone bill, cancel the gym’s membership if you don’t go to the gym, etc. To make more space for those things you need to spend on money, reduce or eliminate expenditure in those areas.

Keep an eye on your expenses for this you will need your, weekly budget planner. During the month, follow your actual expenditure against your budget. If you go as per your weekly budget planner, it will help you to figure out how to spend more cash in the upcoming days. You can also pay more attention to not spending more in that area.

For the extra expense, you will have to adjust your budget if you upsurge your expenses in an area then lower them in the other area by adjusting your budget.

What Your Weekly Budget Planner Should Look Like?

Your weekly budget planner should contain your weekly expenditures. This means you need to plan what are the groceries you need in a week and thus you will be able to increase or decrease your expenses.

NOTE:

The weekly budget planner should contain weekly expenses such as weekly groceries, weekly transportation expenses etc. means the amount you spend in a week.

Conclusion:

The greatest budgeting practices are those that are straightforward, manageable, and customized to your needs and way of life. If you want to achieve financial stability and your goals, this is essential.

Compiling a random assortment of budgeting advice, paying with cash, utilizing credit card points, and/or keeping note of every transaction won’t significantly affect your spending habits or cash flow.

FAQ:

Q. What is a budget planner?

A. The weekly budget planner is an excellent way to calculate liabilities and your home expenditure development costs your home. Budgeting is an important part of a sturdy financial base.

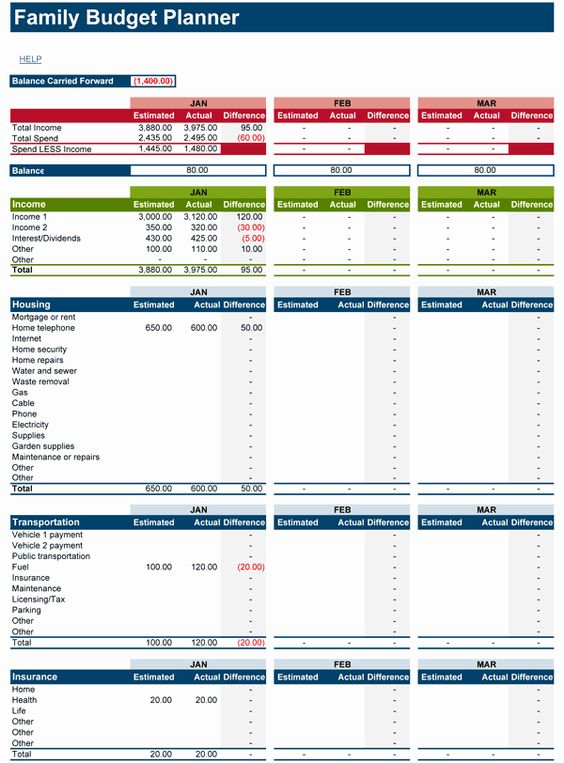

Q. Does Excel have a budget template?

A. Microsoft Excel has a variety of templates, such as the monthly budget, weekly budget, household budget template, etc. This template permits you to relate your expected expenditures against your real bills to record unexpected spending each and every month.

Q. What should be included in a budget spreadsheet?

A. You should include every single purchase & expense, including your regular savings amount, and cover the below-mentioned essentials: Utilities, Your mortgage/rent, Savings for co-payments and medical bills, Health insurance, car insurance, and life insurance, Savings for the child’s education, Money set aside for car repairs and home repairs, etc. in a budget spreadsheet.

Q. How do budget planners save money?

A. Sometimes the toughest thing about saving cash is just to get started. Which we often fail to do. But a budget planner helps us to work out where our money is going, how much we should really spend, and how much we should save.